In the City Manager’s Report presented at every Homer City Council meeting, sometimes the city manager has bad news to share: downturns in the economy or challenging repair projects. At the Dec. 13 council meeting, City Manager Rob Dumouchel had some great news.

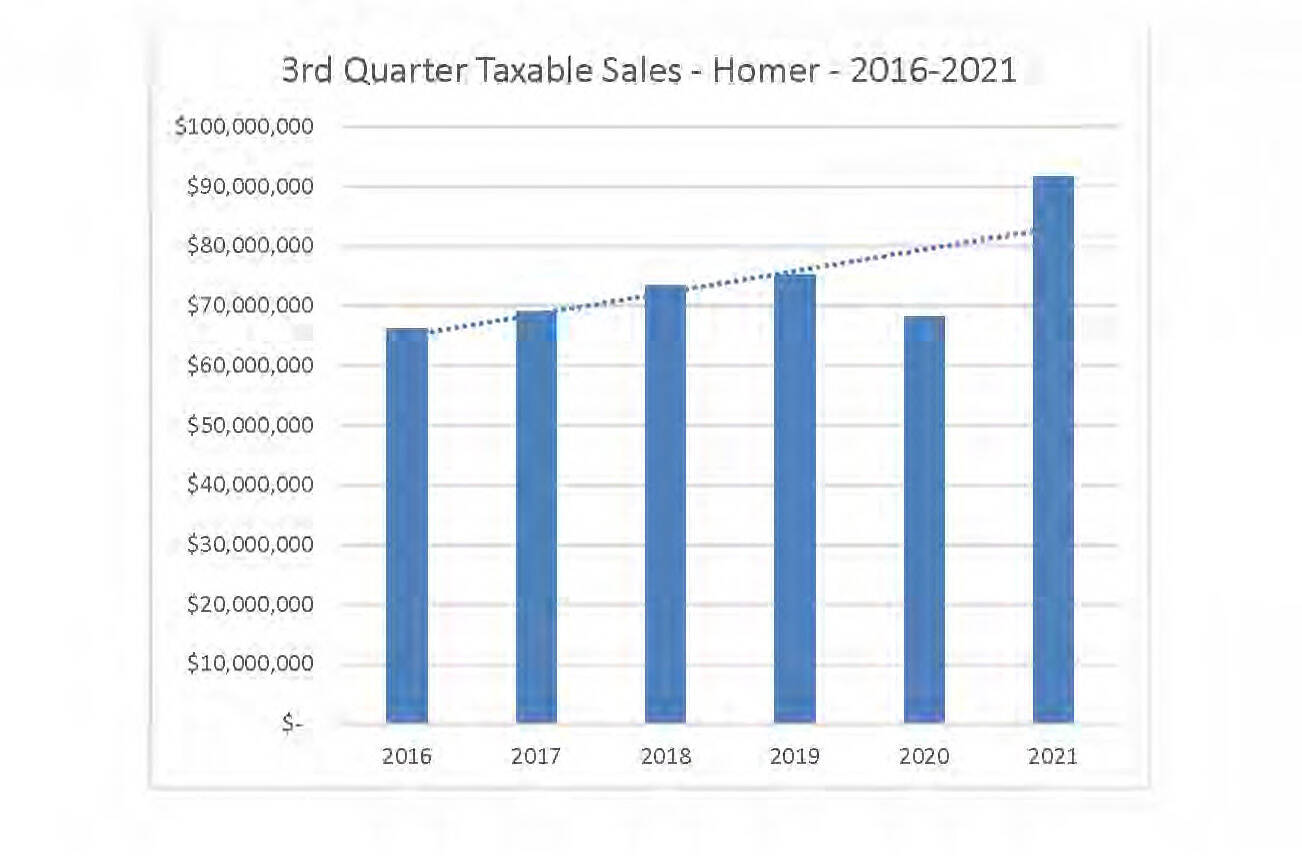

For the third-quarter sales tax report covering July 1 through Dec. 30, the city set a record for the most taxable sales within a single quarter. That quarter coincides with the peak of the summer tourist season, and gives a good snapshot of how well the city did as it recovered from the COVID-19 pandemic. Taxable sales were more than $90 million, netting the city $4.45 million in expected revenue.

When included with actual data through Nov. 30, sales tax receipts are $4.7 million. Another bit of good news is that this is 82% of budgeted sales tax for the fiscal year, meaning that it looks realistic for the city to exceed budget expectations — words a cost-conscious city council always wants to hear.

In contrast to 2020, where third-quarter taxable sales were just under $70 million, that’s a $20 million jump in sales.

“The sales tax data validated our suspicions that we were going to, and did in fact, have a very strong tourist season,” Dumouchel wrote in an email. “When you look at the data for different lines of businesses, we saw strong increases in tourism-related fields such as hotels, restaurants, guiding and retail, which matches up with our observations throughout the summer.”

An attachment from Finance Director Elizabeth Walton shows those gains. Retail trades had the highest sales, at $41 million, followed by restaurants and bars at $11.3 million, hotels, motels and bed & breakfasts at $10.4 million, and guiding-water at $9 million. Guiding-water was double the 2020 sales. Sectors like arts and entertainment also did well at $880,000.

The third-quarter sales tax report also is now the first quarter sales tax report under the city’s new fiscal year budget plan, where the fiscal year starts July 1 and ends July 30. Homer’s 2022 fiscal year runs July 1, 2021, to June 30, 2022.

“I think this is a good example of one of the benefits to the switch to the fiscal year,” Dumouchel wrote. “We now lead off with our strongest quarter instead of our weakest. This lets us know up front what kind of year we’re going to have for revenues. If we miss the mark in summer, we have the rest of the year to make adjustments.”

The manager’s report also includes a new category of sales tax receipts, remote sales tax collection. Dumouchel explained that remote sales tax picks up online sales by businesses that do not have a physical presence in the city or borough. Remote sales tax includes purchases made through Amazon or large online vendors. Those taxes get collected through the Alaska Remote Seller Sales Tax Commission. Remote sales tax receipts to date are $69,000, with the city budgeting $207,000 for the fiscal year.

Reach Michael Armstrong at marmstrong@homernews.com.