Gov. Bill Walker is proposing the biggest changes to Alaska’s system of taxes and revenue since Jay Hammond signed legislation eliminating the state’s income tax in 1980.

In a speech beginning at 11 a.m. in Anchorage, Walker proposed reviving the state income tax, increasing most taxes already collected by the state, eliminating tax credits given to oil and gas drillers, and turning the Alaska Permanent Fund into an engine that generates revenue for the state.

Walker’s plan would reduce but not eliminate the Alaska Permanent Fund dividend. Under the existing PFD formula, next year’s dividend is expected to top $2,000. Under Walker’s plan, the dividend would be $1,000.

Walker also proposes nearly $140 million in additional cuts to state government operations.

In a letter released Tuesday, Walker said his proposal “might not make me the most popular governor, but I didn’t run to be popular. I ran because I love Alaska and am committed to doing the best by our state and our people.”

Walker’s aggressive plan is the boldest yet suggested for balancing the state’s $3.5 billion annual deficit, which has been caused by the plunging price of oil and rising expenditures.

To balance its budget, Alaska needs North Slope oil prices to reach $109 per barrel. On Monday, the price was just over $38 per barrel.

This fiscal year, according to an analysis released Tuesday, the state expects to earn just $172 million in revenue from oil and gas production taxes. Two years ago, the state earned $2.6 billion from those taxes.

Since 2013, the state has slashed general-fund spending from more than $8 billion per year to less than $5 billion. In the 2017 fiscal year, which begins July 1 this year, Walker has proposed a state operating budget of $4.8 billion.

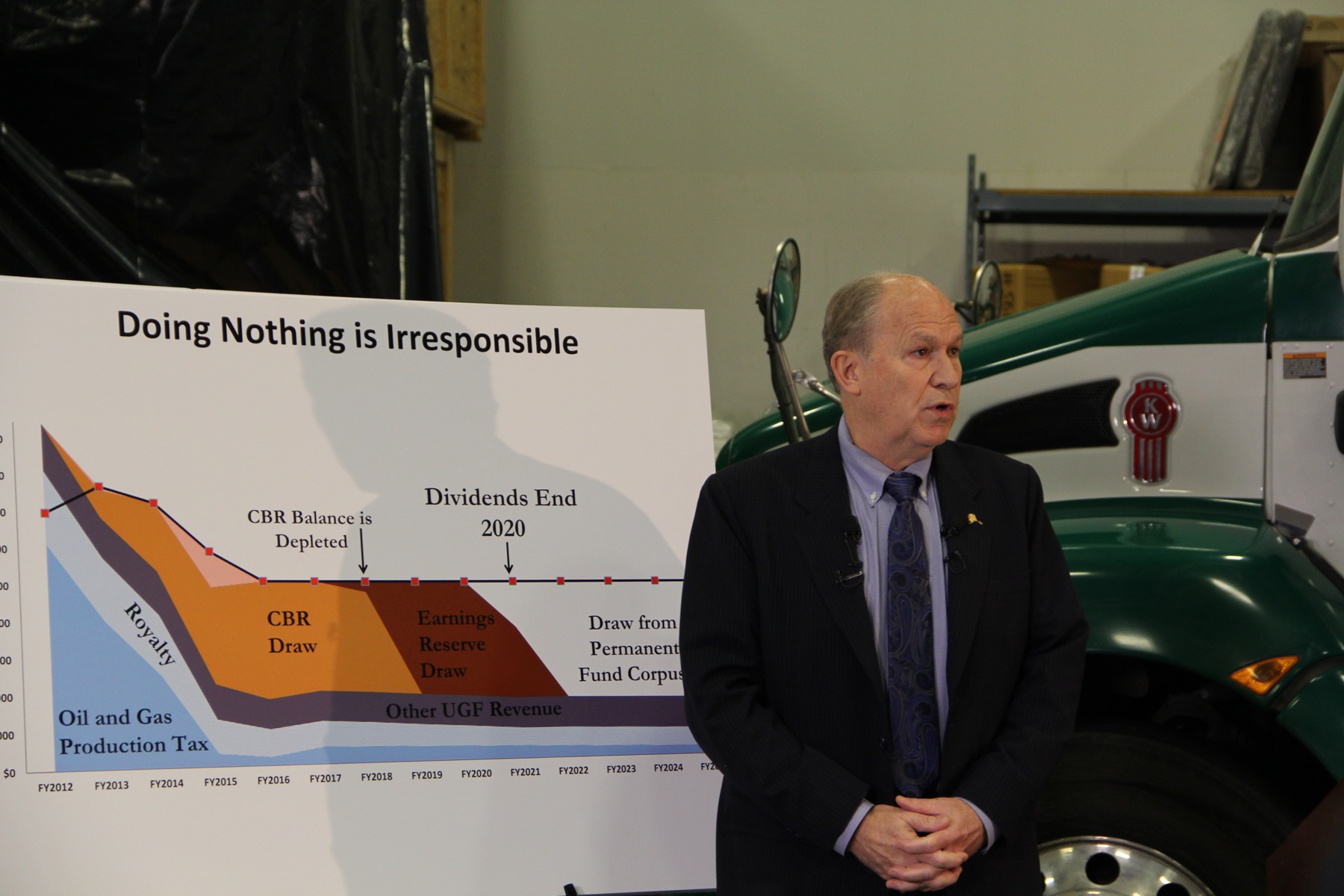

Even those reductions have not been sufficient to close the annual deficit as oil prices have dropped, and the state has been using savings from its various reserve accounts to close the gap.

If the state continues to use savings to finance its annual deficit at existing levels, those reserve accounts will be empty by 2020, and the state will run out of money to pay the permanent fund dividend. The state would be forced to choose between radical spending cuts or spending the $50 billion principal of the Alaska Permanent Fund itself.

Furthermore, global credit rating agencies have indicated that if the state fails to act this year, it may lose its top credit rating, which would make borrowing to finance the trans-Alaska natural gas pipeline more costly.

During a special session of the Alaska Legislature in late October, Walker’s administration rolled out a proposal that would turn the permanent fund into a money factory for the state.

“It is now clear that, barring a change in the economic environment, that our financial wealth assets will generate substantially more income than petroleum revenues in the future,” Attorney General Craig Richards told the Legislature.

By putting all of the state’s savings into the Permanent Fund and continuing to invest that fund in global markets, the state would earn interest that could be spent on annual expenses.

It’s akin to a person who wins the lottery but puts his winnings into savings accounts and lives off the interest.

In the state’s case, the plan would earn about $3.2 billion per year on a consistent basis. As long as the state averages a 6.7 percent return on its permanent fund investments (it has averaged 6.4 percent over the past 10 years — a period that includes the Great Recession), the arrangement could be kept up forever, Richards said.

That $3.2 billion is not enough to completely close the deficit, which is why Walker is also proposing a broad range of tax increases and new taxes. Among them:

— Implementing a state income tax;

— Higher taxes on alcohol and tobacco;

— Higher taxes on gasoline, aviation fuel and marine fuel;

— Higher mining taxes;

— The elimination of oil and gas tax credits and their replacement with a loan fund;

— Tourism head tax changes.

Those tax changes, broad in scope, are intended to ensure that all Alaskans shoulder a portion of the burden, administration officials said. Precise amounts were still being determined Wednesday morning, and the administration could only provide a draft proposal without final tax amounts.

The income tax would be 6 percent of a person’s federal income tax returns. A person paying $600 tax to the Internal Revenue Service would pay $36 in state tax, for example.

That rate would be lower than assessed by the state before 1980, when Jay Hammond signed legislation that eliminated the state’s previous income tax.

Walker’s proposal is expected to meet fierce debate in the Alaska Legislature, which will open its regular session on Jan. 19.

“I’m so excited for Alaska’s future,” Walker said on Tuesday. “I know we are challenged by tough fiscal times, but we’ve never defined ourselves by how much money we have. We’re a state made up of Alaskans of all walks of life that do what needs to be done to get the job done, and that’s exactly what we’re going to do. Yes, we have some challenging fiscal times, but that doesn’t change who we are. We’re Alaskans, and we’re proud of it.”

James Brooks is a reporter for the Juneau Empire.